Epstein's Empire: Where Did It Come From?

From failed teacher, to jet-setting pedophile billionaire. How did this happen? Let's follow the money.

Jeffrey Epstein (1953–2019) was an enigmatic figure: a financier with a palace-like Manhattan mansion and a private island, whose immense wealth has long defied clear explanation. Over decades he professed to manage money for billionaires, but he never publicly disclosed clients or revenue streams. Investigators have since uncovered a web of offshore companies, real-estate deals, and boardroom ties that fuelled his fortune. Court filings, leaked documents and investigative reports reveal that Epstein’s empire was built on mystery clients, offshore shell companies, and favours from the powerful, rather than any obvious business model. In this exposé we trace Epstein’s known and suspected money sources through his career, from Bear Stearns to his Wexner patronage, his offshore trust network, and the financial manoeuvres that left prosecutors and journalists baffled.

Early Career and Bear Stearns

Epstein’s own account of his career has always been sketchy. After dropping out of college he taught mathematics and physics at NYC’s Dalton School. Donald Barr, the father of former Attorney General William Barr, was headmaster of the Dalton School in Manhattan from 1964 until 1974. He stepped down in the summer of 1974. Notably, Jeffrey Epstein began teaching at Dalton in September 1974, shortly after Barr’s departure—making it unlikely that Donald Barr directly hired him.

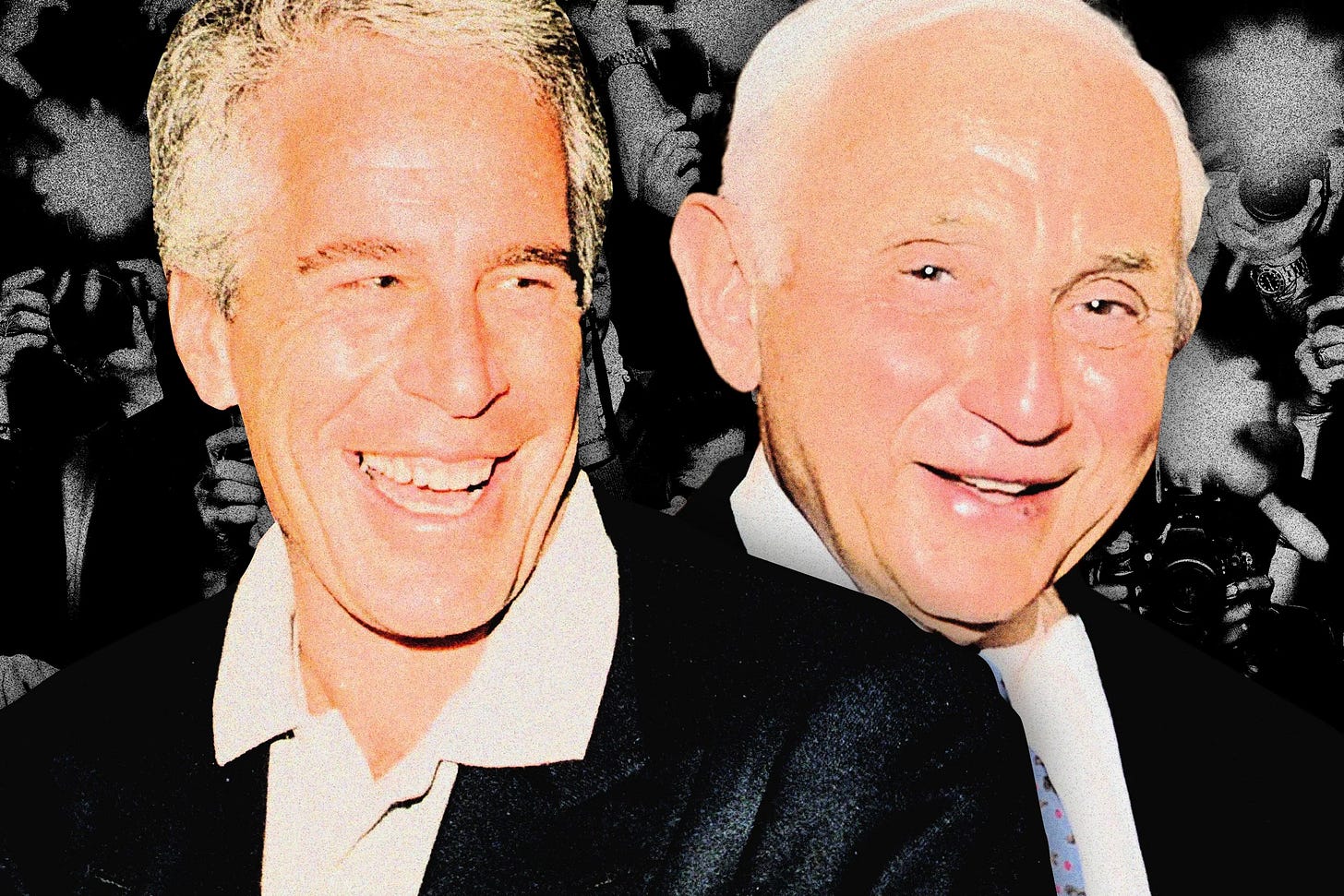

There he caught the attention of Bear Stearns chairman Alan “Ace” Greenberg: Epstein tutored Greenberg’s children, who later helped him get hired at the Wall Street firm. From 1976 to 1981 Epstein worked at Bear Stearns in various roles and reportedly earned a partnership by age 27. But the details of his time at the bank remain unclear. By 1981 Epstein left Bear Stearns to form his own money-management firm, J. Epstein & Co., which claimed it would handle money only for the ultra-wealthy. In fact, Epstein later boasted that he served only billionaires, yet the only publicly confirmed client from this era was Les Wexner. Former Bear Stearns executives say he remained on friendly terms with the firm after he left, but no record shows any major deals there after 1981.

The only glimpse we have into Epstein’s early finance ventures comes from leaked documents. According to the International Consortium of Investigative Journalists (ICIJ) Paradise Papers, by the mid-2000s Epstein chaired Liquid Funding Ltd., an offshore Bermuda corporation that piled mortgage-backed securities and commercial mortgages into collateralised loan obligations. Liquid Funding was partly owned by Bear Stearns, suggesting Epstein maintained ties to his former bank. Those private-label securities, later tied to the 2008 crisis, show Epstein was playing in big-money finance — but the ultimate source of the capital in those deals remains opaque.

Epstein’s early years also connected him to a much older financial fraud. In the early 1980s he was briefly associated with Steven Hoffenberg, a con man later convicted for a $475 million Ponzi scheme involving Towers Financial. Hoffman claimed he helped Epstein land clients, and Epstein worked on Hoffenberg’s failed bid for the New York Post in 1991. (Epstein has denied that Hoffenberg “made him,” insisting he already had rich clients.) Still, Hoffenberg became a witness in later legal battles, alleging Epstein participated in fraud. When Hoffenberg’s scheme collapsed, Epstein quietly dissolved their firm, but the episode raised suspicions that Epstein had honed skills at financial chicanery early on.

The Wexner Connection

The key turning point in Epstein’s rise was meeting Leslie “Les” Wexner, the billionaire founder of L Brands (Victoria’s Secret, Bath & Body Works). By his own account, Epstein began advising Wexner on investments in the mid-1980s; by 1989 he was Wexner’s personal money manager and confidant. Wexner entrusted Epstein with enormous power over his finances. In a 2003 Vanity Fair profile, Wexner confidant Harold Levin recalled Epstein boasting on Levin’s last day of work that Wexner had given Epstein power of attorney over his estate — a claim Levin doubted he’d see himself. Multiple sources later confirmed that Epstein was deeply embedded in Wexner’s world: he sat on Wexner’s family philanthropic boards, managed personal trusts, and even oversaw Wexner’s luxury yacht construction. Wexner once remarked, “We have one brain between two of us,” to describe their partnership.

“Wexner was this super-successful guy who didn’t really have any life, and Jeff described him to me as completely socially inept,” Julie said. ”Jeffrey was like, ‘Look at me now, wow, look at where I am,’ and it was exciting for him.”

Epstein’s most visible windfall was Wexner’s New York townhouse at 9 East 71st Street (the Herbert N. Straus House). Wexner — who bought the former private school building in 1989 for $13.2 million — effectively gave Epstein the use of this 25,000-sq.-ft. mansion. Epstein moved in around 1995, and public records suggest Wexner “sold” or transferred the house to shell companies controlled by Epstein in 1998. In fact, documents show Wexner initially sold the house to a New York corporation (NES LLC) and by 2011 those ownership rights quietly passed to Epstein’s USVI company Maple Inc. for $0. In other words, Epstein ended up owning Wexner’s prime property without paying for it — a dramatic gift that no doubt jump-started his lavish image. (Wexner later said he cut ties with Epstein “more than a decade ago” and claimed he “never was aware” of any illegal behaviour.)

Epstein wasn’t shy about capitalising on Wexner’s fortune. News reports show that from 1991 onward, Epstein took control of valuable Wexner assets: besides the Manhattan house he ran, he negotiated for Wexner’s Ohio estate and even the retail fortune. Wexner abruptly married in 1993 and moved to Ohio, leaving Epstein effectively in charge of his East Coast holdings. After Wexner gave Epstein general power of attorney (reportedly in the early 1990s), Epstein signed documents on Wexner’s behalf, such as indemnifying co-investors at sales. Leaked emails and lawsuits suggest Epstein gained signature authority over Wexner’s trusts and foundations. In 2007, after Epstein was first charged with crimes in Florida, Wexner secretly sold an Ohio compound to a business associate of Epstein. New York Times reporting (cited by Business Insider) later revealed that Epstein had been running many of Wexner’s private foundations and even enjoyed Wexner’s corporate jet.

“He digests and decodes the information very rapidly, which is to me terrific because we have shorter meetings.” – Wexner, on Epstein

Epstein’s relationship with Wexner remains a wellspring of questions. Did Wexner simply trust Epstein’s financial acumen (or ruthlessness), or did Epstein actually siphon money from Wexner? Wexner’s aides say Epstein insisted he was indispensable — “he digests and decodes information very rapidly,” one associate recalled Wexner telling company managers — but in hindsight Wexner has disavowed Epstein, saying only that he “regretted” their association. We do know that Wexner eventually reclaimed the Manhattan house after Epstein’s 2019 arrest (it was later sold by the estate), and that Wexner transferred other assets when breaking off. What’s less clear is whether Epstein at any point secretly transferred Wexner’s money into his own offshore accounts. Some reports allege millions did flow Epstein’s way; a Senate-finance letter (2025) notes Epstein’s Virgin Islands assets were “partially funded” by $170 million from billionaire Leon Black — work his office may have done while at Wexner’s side. But even Wexner’s top lieutenants say they never imagined Epstein committing crimes. All that remains certain is that without Wexner’s patronage and transferred property, Epstein’s visible fortune would have been far smaller.

Farmer, a painter, was at the Wexner mansion at Epstein’s invitation for what she believed was an art residency when, she alleges, Epstein and Maxwell sexually assaulted her and held her hostage for 12 hours with the aid of Wexner’s massive security team. After the ordeal, Farmer soon learned that her younger sister had also been assaulted by Epstein and Maxwell during a similar “artist residency.”

Corporate Entities and Offshore Web

Epstein’s wealth was largely hidden behind a tangle of companies, trusts and foreign entities. Investigations have identified dozens of shell companies and foundations tied to him. Some were openly linked to Epstein’s businesses, others cloaked in secrecy.

Offshore companies

Leaked internal files from Appleby (the offshore-services firm) revealed Epstein’s extensive use of tax havens. From 2000–2007 he chaired Liquid Funding Ltd., a Bermuda firm funding mortgage and CLO deals; partially owned by Bear Stearns, it traded in the same products later blamed for the financial crisis. After Bear Stearns collapsed in 2008, Liquid Funding’s activities vanished from public view. Epstein also incorporated his main operating company in the U.S. Virgin Islands (registered as Financial Trust Co. or the Financial Trust of the Virgin Islands), which gave him privacy and tax benefits. This V.I. shell company (and its ilk, with benign-sounding names like COUQ or Gratitude American Ltd) handled money flows among his assets.

Manhattan entities

Closer to home, Epstein formed dozens of U.S. corporations to own real estate. For example, the Manhattan townhouse passed through NES LLC and then to Maple Inc. (USVI). Court documents show he signed as president of both the buyer (Maple) and seller (NES) to transfer the $77M property for $0. Other domestic LLCs were likely used similarly. Epstein’s Palm Beach mansion (sold after his death) was held by Palm Beach Alps LLC, whose co-executor disputed several fraudulent title claims in court. Little St. James and Great St. James were owned through Virgin Islands entities (often simply called “Little St. James LLC” or “Great St. James LLC”), making them USVI corporate assets under his control.

Family foundations

Epstein set up at least four private foundations. The best-known is the Jeffrey Epstein VI Foundation (founded 2000), which he used to donate to scientific research (funding Princeton professor Martin Nowak, among others ). He also ran charities named Epstein Interest, COUQ Foundation, and Gratitude America (sic) Ltd. Tax filings show he gave tens of millions through these entities, but critics note that Epstein’s charities were unusually opaque. They reported few details and no assets on public forms, leading watchdogs to suspect they masked personal wealth.

Plan D and aviation companies

Epstein’s private jet “Lolita Express” (a Boeing 727) and a Gulfstream IV were held by corporate layers. Leaked SEC filings reveal an entity called Plan D LLC (USVI) owned his aircraft. (Plan D also appears in witnesses’ notes as part of certain loans in Leon Black’s family office litigation.) This suggests Plan D was effectively Epstein’s aviation arm in the Virgin Islands. Another small company, E11 LLC, registered an aircraft tail number (N212JE) and was once owned by Epstein. In short, almost every asset — planes, mansions, islands — was held by anonymous LLCs, so that tracing ownership required combing through 13,000 pages of court filings.

The net effect of this corporate web was to obscure how wealth moved in and out. Major banks kept him as a client despite warnings: as late as the 2010s, JPMorgan Chase and Deutsche Bank were still carrying Epstein’s accounts, some staffed by executives he knew. When lawsuits finally revealed the money flows, they found that Epstein’s dozens of accounts “dozens of bank accounts, shell companies and, at times, charities” were funnelling funds. In 2025, Senator Ron Wyden disclosed that U.S. regulators obtained FinCEN reports showing “hundreds of millions of dollars in payments to Epstein by several ultra-wealthy individuals” used for his trafficking network. These reports – still withheld from Congress – describe transactions so opaque that banks failed to file suspicious-activity reports.

The Real Estate Empire

Epstein’s property portfolio was extraordinary, far beyond what a typical asset manager would own. It included homes in New York, Florida, the Virgin Islands, New Mexico, and abroad. His estate was conservatively valued at over $500 million at death (so technically not a billionaire, but certainly had the lifestyle of). Not surprisingly, investigators focused on these concrete assets for clues.

Epstein’s Little St. James Island in the U.S. Virgin Islands (pictured above) was the site of his primary residence and alleged crimes. Epstein bought Little St. James for about $8 million in 1998, and later purchased the neighboring Great St. James for ~$20 million.

Manhattan Townhouse

The famed 9 East 71st Street Straus House was Epstein’s headquarters and opulent trophy. As noted, Wexner originally bought this 25-room mansion and turned it over to Epstein in stages. Epstein lived there from the mid-1990s onward, ostensibly paying no rent. After his 2019 arrest, prosecutors raided the townhouse and found evidence of an underground rape room and a safe full of cash. The house was sold in 2021 for about $51 million. (That sale generated millions for the victims’ compensation fund.)

Little St. James (“Pedophile Island”)

Epstein’s 70-acre island retreat near St. Thomas was where he “established his permanent residence” by 2010. He dubbed it “Little St. Jeff’s” (though locals call it “Pedophile Island”). According to property records and testimony, he paid ~$8 million for Little St. James in 1998. There he built a gated compound with a mansion, guest houses, helipad and other amenities. Victims’ stories and photographs (some recovered by police) detail abuse that took place there. The island was listed for sale during estate liquidation, with liens by the U.S. Virgin Islands government due to civil litigation.

In May 2023, Little St. James was sold—along with neighbouring Great St. James—for $60 million to billionaire investor Stephen Deckoff. His firm, SD Investments, plans to redevelop both islands as luxury resorts by a rather aspirational end of 2025. Proceeds from the sale are being used to fund victim compensation and settle lawsuits brought by the USVI government.

Great St. James

In 2016 Epstein acquired neighbouring Great St. James (65+ acres) for roughly $18–20 million. He cleared land and drafted plans for an amphitheatre and oceanfront estates, but the project remained incomplete by 2019. Like Little St. James, it was placed on the market as part of the estate’s asset purge and was sold in 2023 as part of a bundled purchase by SD Investments.

Palm Beach Mansion

Epstein owned a 7-bedroom Mediterranean-style house on Palm Beach’s Billionaire’s Row, which was the site of many of his early crimes. He bought it in 1990, reportedly for about $10 million, using yet another Florida LLC. The Palm Beach house was first put under contract after his death; land records entangled it in fraudulent liens. It is believed sold for around $25.8 million (much higher than the expected $18M), with proceeds going to the estate’s estate (and the buyer planning to tear it down).

Zorro Ranch (New Mexico)

Far from the East Coast, Epstein owned a 7,500-acre ranch near Stanley, New Mexico, called “Zorro.” He purchased the deed in the 1990s (price unknown, at least millions) and frequently retreated there. The Time/Bloomberg profile noted it as the “largest private dwelling in New Mexico”. In 2022 the ranch was listed for sale (asking $85M) with a handful of other assets. It sold in mid‑2023 to San Rafael Ranch LLC for an undisclosed amount.

Avenue Foch (Paris)

Epstein also owned a luxury apartment on Avenue Foch in Paris. French prosecutors froze this asset after 2019; it, too, was listed for sale, and Sold in late 2022 for about €10.4 million (~US $11 million).

Aircraft and vehicles

Besides property, Epstein had a small army of vehicles. He owned (through trust) at least one Boeing 727 jet (“Lolita Express”), a Gulfstream IV, and a helicopter. Plans were discovered for two private jets on his New Mexico property. Epstein’s Boeing 727 and other aircraft were auctioned off in 2020, after initially being part of estate liquidation. Federal filings list 15 cars (including seven SUVs) in his name. The aircraft were registered to offshore companies like Plan D LLC (USVI).

In summary, Epstein’s assets resembled those of a hedge-fund billionaire. They were principally real estate and transportation — each held in layers of LLCs. USVI Attorney General Denise George pointed out that in running his trafficking ring Epstein tied together “properties, shell companies and charitable organisations”. This integration of wealth and control over physical sites was critical: the very places that generated allegations of abuse were also his most valuable investments.

Banking, Transactions and Financial Anomalies

Epstein’s fortune was not kept under his mattress — it moved through financial institutions that later drew scrutiny. Lawsuits and Senate letters outline a picture of enormous cash flows and banking oversights.

JPMorgan Chase (1998–2013)

Epstein banked for many years at JPMorgan. Suit filings show that from 1998 to 2013, JPMorgan “regularly allowed him to withdraw large sums of cash,” despite internal warnings. He kept surprisingly liquid accounts – tens of millions on deposit, routinely converted into cash or checks. JPMorgan executives, including CEO Jamie Dimon, claim they did not know the extent of Epstein’s crimes until late 2019, but the bank’s own compliance unit filed internal alerts. Yet Epstein’s accounts persisted even after his 2006 Florida arrest. In 2023, JPMorgan agreed to pay $290 million to settle a lawsuit by Epstein’s victims alleging the bank “aided and abetted” his abuse by failing to stop suspicious transactions.

Deutsche Bank (2013–2018)

After JPMorgan closed Epstein’s account in 2013, he moved to Deutsche Bank. Here, too, internal memos questioned the relationship: an internal review (later leaked) shows Deutsche Bank’s U.S. branch shut Epstein’s accounts in 2018 and paid $75 million in 2023 to settle a similar victim lawsuit. Deutsche’s forms show Epstein wired millions from both banks into offshore entities. For example, one Deutsche Bank compliance memo from 2018 noted an account transferring hundreds of thousands from Epstein’s Palm Beach LLC to a BVI hedge fund.

“Wire and Cash Transfers”

Beyond banks, Epstein’s companies engaged in frequent wire transfers among affiliate accounts. Court exhibits (e.g. Virgin Islands’ racketeering suit) list numerous transactions between entities such as Plan D, Liquid Funding, Maple Inc., and others, often for “management fees” or “loans.” Very little goods/services backed these transfers, raising suspicions. Epstein was also known to travel with large amounts of cash. In early 2019, his lawyer reported that Epstein had hoarded $70,000 in cash, hidden for use if he fled. After Epstein’s death, executors found envelopes of cash in his safe.

Asset Valuations

The official valuation of Epstein’s holdings has been opaque. His lawyers once claimed a nine-figure net worth, but independent valuations vary. For example, a New York court listed the Manhattan townhouse’s value at ~$77 million, yet the sale closed at $51 million. The Virgin Islands properties are tied up in litigation, so have no clear market value. Banks and trustees largely pegged Epstein’s estate at around $500–600 million after 2019. But this figure changes as lawsuits proceed and assets sell off. Notably, the “Epstein Victims’ Compensation Program” managed by his estate has demanded full transparency, holding back disbursements until all sources of funds are documented.

Suspicious Activity and Investigations

Government reports hint at financial red flags. In 2025 the Senate Finance Committee revealed that Treasury’s FinCEN unit compiled evidence on “hundreds of millions” paid to Epstein by wealthy figures that then financed his trafficking. Internal memos cited by Sen. Wyden show transactions “indicative of money laundering,” such as large sums moving through V.I. shell accounts without clear purpose. Authorities have cited Epstein’s wealth as a major flight risk – indeed, his cash holdings and offshore accounts gave him an ability to disappear.

All this points to a pattern: Epstein maintained remarkably open flows of money that should have triggered greater scrutiny. Only belatedly have bankers and regulators started catching up. The whistleblower language in suits and letters suggests they suspect his network was being used to launder illicit gains or hide payments for illegal services. Whether any of these transactions was provably illegal (aside from funding abuse) remains to be seen. But the timing is notable: for example, large incoming wires (from associates like Leon Black) coincided with outgoing payments to Epstein’s Virgin Islands firms around 2017–2019, the height of his renewed offences.

The 1593 Trust

In a final act of obfuscation, Epstein signed a new will just two days before his death, transferring his entire estimated $577 million fortune into a freshly formed private trust known as “The 1953 Trust.” The move shielded his wealth from immediate public oversight and delayed disclosure of beneficiaries, creating a legal firewall that complicated civil suits and asset recovery for victims. Named executors Darren Indyke and Richard Kahn—a longtime lawyer and accountant for Epstein—were entrusted with managing the estate, but both have since faced their own legal scrutiny. While U.S. Virgin Islands courts have gradually begun piercing the trust’s secrecy, and some funds have trickled into victim compensation programs, large portions of Epstein’s financial empire remain locked behind layers of fiduciary shielding, continuing the pattern of concealment that defined his life.

“There are no Epstein files”

Allegations of Blackmail, Kompromat and Intelligence Ties

Beyond finance, Epstein’s wealth has been entwined in conspiratorial allegations of espionage and blackmail. Some former intelligence officers and authors allege Epstein was a conduit of “kompromat” – compromising material used to entrap powerful figures. These claims are controversial and mostly unsupported by hard evidence, but they have become a persistent part of the lore.

One prominent proponent is former Israeli intelligence operative Ari Ben-Menashe, who told press outlets that Epstein was “taking photos of politicians fucking fourteen-year-old girls” for Israel’s military intelligence. Ben-Menashe claims that Epstein and Ghislaine Maxwell collaborated on “blackmail operations” introduced to them by publishing mogul Robert Maxwell. He portrays Epstein not as a rogue financier but as a supplier of secrets to foreign agencies. These claims are echoed in alternative media: Consortium News reported Ben-Menashe’s account that Epstein was working “for Israeli military intelligence” (not Mossad) and helped blackmail Western figures via personal exploitations. However, mainstream journalists and official investigators have not verified these assertions. There is no public record of Epstein ever being formally linked to any spy agency. Intelligence experts note that Epstein’s patterns (wealthy friends, surveillance gear, photography) could fit standard spycraft, but they also point to simpler explanations (he was a control-freak exploiter).

Some journalists have explored these spy-tinged angles. In his reporting on Epstein’s death, Investigation Discovery producers suggested dark intelligence links might underlie the mystery. Netflix’s Filthy Rich did not delve into espionage, focusing instead on victims’ stories. Vicky Ward – the Vanity Fair reporter who knew Epstein in 2002 – has said she was threatened by Epstein with vague references to her personal life, but she herself does not claim he was a spy. Ward’s main allegation is that Epstein intimidated media and powerful friends to keep his crimes under wraps.

What is documented is Epstein’s collection of dirt on others. He maintained a bank of graphic photographs and videos of underage girls, some of whom later testified to being trafficked. Victims allege these materials were meant to generate blackmail leverage over their wealthy targets. But the actual use of this material as ransom remains speculative. To date, no victim has confirmed that Epstein threatened anyone with exposure of their secrets. Prosecutors have focused on his crimes of abuse and trafficking, not on any espionage charges.

Nonetheless, the intrigue persists. Epstein’s social circle included politicians (Bill Clinton, Prince Andrew, Donald Trump) and media tycoons, all potential targets of kompromat. The fact that Epstein navigated the highest echelons for years without legal consequence has fueled speculation that someone protected him. To date, however, investigators have cited only conventional corruption: accepting favours, ignoring warnings, and abusing influence. No official inquiry has concluded that state actors were involved. In sum, while blackmail and intelligence rumours swirl, they remain in the realm of unproven theories. Key investigative accounts (Ward, Brown, law enforcement) have not found conclusive evidence of espionage: their emphasis is on “dirty work” (such as drug deals and payoffs) Epstein did for Wexner and others.

Suspected Money Laundering and Ponzi-Adjacent Schemes

Given Epstein’s associations and methods, some analysts have connected him to Ponzi-like schemes and laundering networks. The most straightforward link is his one-time mentor Steven Hoffenberg. Hoffenberg ran a Ponzi fraud at Towers Financial in the early 1990s, and Epstein helped him solicit investments. Hoffenberg later told prosecutors that Epstein was treated like a business partner – a charge Epstein denies. In 2007, the SEC sued Hoffenberg (then in prison) and Epstein for fundraising abuses; by then Epstein had cut ties and was not charged. This episode suggests Epstein may have participated in or profited from Hoffenberg’s scheme (estimated at $475M) without accountability.

On a broader scale, U.S. Senate documents hint at deeper layers of financial misconduct. Senator Wyden’s 2025 letter describes Epstein’s network moves as “engag[ing] in dubious transactions indicative of money laundering”. For example, FinCEN reports allegedly show Epstein receiving a $25 million wire from Leon Black in 2013, part of a total $170 million Black later admitted paying. Black’s own settlement with the Virgin Islands AG explicitly acknowledges this money “partially funded” Epstein’s Virgin Islands operations, implying it supported trafficking activities. Critics speculate Epstein used these funds to pay underage girls or launder proceeds through his shell companies. If true, this would be a form of criminal enterprise financing – not quite a classic Ponzi scheme, but a complex laundering structure.

In a striking expansion of his investment portfolio, Jeffrey Epstein quietly funneled $40 million into two Valar Ventures funds—a firm co‑founded by Peter Thiel—during 2015–2016. A New York Times–reviewed confidential estate report reveals that this capital has since ballooned to nearly $170 million, making it the largest remaining asset in Epstein’s estate. While victims of Epstein’s trafficking have already received settlements—typically ranging from half a million to $2 million—most of this Valar windfall is “locked up” in venture fund constraints and may instead benefit one of Epstein’s former girlfriends or close advisers . These details not only highlight a rare foray by Epstein into tech VC but also expose a deepening financial entanglement with Peter Thiel’s funding ecosystem—far removed from the hedge funds and real estate that shaped his public persona.

Investigators have also flagged suspicious cash patterns. A 2025 Senate hearing summary noted how major banks “waived payments through without properly reporting them”. In one example, an Epstein-linked aircraft company reportedly borrowed $10M from Black’s trust in exchange for art, then quickly sold the art and repaid the loan, moving money around with unclear purpose (reported in the SEC’s disclosure on Black). Additional documents (yet unsealed) may reveal systematic layering of cash via gold dealers, accountants, or casinos, as has been suggested by New York prosecutors.

In popular culture and some journalism, Epstein’s finances have often been likened to a Ponzi scheme – endless recruitment of rich investors to pay earlier ones. The parallel is loose: Epstein did promise wealthy clients extraordinary returns (and once gave Clinton $5M as “example” profits ). But no conclusive evidence has emerged that he took investors’ money to pay others. The money-laundering angle, however, remains active. U.S. regulatory sources say that Treasury units compiled “extensive information” on how Epstein’s fund transfers skirted anti-money-laundering rules. The ongoing court cases in New York and the Virgin Islands are likely to explore these leads.

Unraveling the Estate: Posthumous Revelations

Epstein’s sudden death in 2019 left many financial stones unturned. In the two years since, court-appointed executors have begun liquidating his estate, uncovering more clues.

Estate Inventory

In 2019 co-executors White & Case reported Epstein’s estate held “more than $556 million” in assets. This included real estate (the properties above) and an account at Deutsche Bank. Unsealed affidavits revealed details: e.g. a Manhattan safe contained about $100,000 in cash and jewels. Bank records obtained by investigators showed dozens of accounts: “Epstein’s portion” of JP Morgan accounts, USVI accounts named “Plan D” etc.

Property Sales

Since 2020, many of Epstein’s properties have been sold. The Manhattan townhouse closed at ~$51M, with sale proceeds earmarked for victim compensation. The Palm Beach house sold for roughly $25.8M and is slated for demolition. The New Mexico ranch and Paris apartment were listed on the market and sold in 2023 and 2022. Most notably, in 2023 the estate listed Little and Great St. James together for $125M. However, all Virgin Islands assets are subject to court liens – Denise George’s civil RICO suit locked them up. Once settled they were sold for $60M to SD Investments.

Bank and Brokerage Accounts

Victor’s reports indicate Epstein had about $40 million in bank accounts at death, mostly at Deutsche Bank. His brokerage account at Fidelity was empty (his assets were real estate and trusts). Executors have amassed billing statements hinting at payments from aircraft to his estate, but they’re fighting with Deutsche over account access. Separately, the U.S. Virgin Islands AG obtained an order to freeze over $100 million in Epstein’s trust funds, claiming they were proceeds of racketeering.

Debt and Settlement

Epstein’s estate inherited litigation. His lawyers set up a Victims’ Fund; by 2021 they had paid out $121 million to claimants, closing in 2022. But many creditor claims remain (including for unpaid contractors and labor taxes). The Swiss bank Julius Baer was ordered in 2024 to hand over nearly $15 million of Epstein money to the USVI government, deemed slush funds for trafficking. And in 2025, a whistleblower depositions revealed that one of Epstein’s private bankers (JPMorgan’s Jes Staley) misled investigators about Epstein’s transactions in 2013.

Each new disclosure tends to raise as many questions as it answers. For instance, property appraisals submitted in court are often wildly inconsistent. Epstein’s New Mexico land was once assessed at $18M, then marketed above $80M. Manhattan’s townhouse was valued at $77M in a bail filing but sold at $51M. These discrepancies could signal hidden mortgages, undervaluation, or simple market shifts. Investigators continue combing emails and phone records from Epstein’s finance team and executors. Just this year (2025), Senator Wyden revealed there is a trove of FinCEN (banking) records and DOJ files that may show exactly how Epstein’s backers kept him afloat.

Voices of Investigation: Journalists and Whistleblowers

Throughout this saga, certain reporters and sources have shaped our understanding. Among them:

Vicky Ward (Vanity Fair)

Ward knew Epstein in the early 2000s and wrote about him extensively. Her 2003 profile “The Talented Mr. Epstein” exposed his lavish lifestyle and ties to Wexner, though it eschewed any mention of the crimes she suspected. Ward later claimed she was “silenced” from publishing girls’ abuse stories at VF due to Epstein’s influence. She revealed that in interviews Epstein boasted of controlling Wexner’s funds (even joking they had “one brain”). Ward’s reporting laid much of the groundwork: she documented Epstein’s New Mexico ranch, his private jet politics, and raised early warning flags. In recent years Ward has continued probing Epstein, now focusing on his crimes and Maxwell, often on podcasts and a forthcoming book. Her journalism underscores Epstein’s self-fashioned myth: “He ran a money management firm catering to the ultra-rich, primarily for … Les Wexner”, even as details of that wealth remained hidden.

Julie K. Brown (Miami Herald)

Brown’s multi-year investigation culminating in 2018 finally broke open Epstein’s criminal case. While her beat was sexual abuse, she also chronicled how justice was subverted by wealth. In interviews Brown has described Palm Beach as a town where “money talks with a confident authority,” giving Epstein impunity. She exposed the sweetheart Florida plea deal of 2008 and tracked how Epstein effortlessly re-entered elite circles. Though Brown doesn’t focus on finance, her work connected the dots of influence and silence that let Epstein hide money. For instance, Brown revealed that prosecutors regularly lost Epstein’s hard drives or were stonewalled by defence lawyers — behaviour consistent with a client shielded by wealth. Brown’s accounts remind us that many formerly closed eyes may reopen as pressure builds in Epstein’s complicated legacy.

Ari Ben-Menashe (former Israeli Intelligence)

A controversial figure, Ben-Menashe portrays Epstein as having spied for Israeli interests. In press interviews he claims Epstein and Maxwell ran blackmail ops, using compromising photos to manipulate Western elites. He also ties in Princess Andrew as Epstein’s unwitting recruiter. These sensational allegations lack documentary support and are dismissed by mainstream media, but some niche outlets (Consortium News) give them space. In July 2025, Ben-Menashe released excerpts from his book Epstein: Dead Men Tell No Tales, reiterating that narrative. While not considered credible by most journalists, his claims contribute to public pressure to explain the source of Epstein’s unusual wealth. He insists (inconsistent with many others) that Epstein’s true patron was “military intelligence” of Israel. If ever substantiated, such ties would revolutionise this story; so far they have not been.

Accounts by Victims and Associates

Many victims and insiders have shed light on Epstein’s money. Virginia Giuffre (Roberts) testified that Epstein introduced her to “powerful people” who financed his lifestyle. Former associates like Ghislaine Maxwell’s ex-lover, journalist Igor Doronkin, have described Epstein slinging cash around Europe for black ops. These narratives are scattered and often under legal seal, but they keep the focus on the question: why did so many rich men pay Epstein so much?

Key Entities and Assets Linked to Epstein

Leslie Wexner

Retail billionaire and the sole known financier client of Epstein. Wexner gave Epstein power of attorney over his trusts and transferred major assets (Manhattan townhouse, yacht, etc.) to him.

Manhattan Townhouse

9 East 71st Street (Straus Mansion). A 25,000-sq-ft UES private home originally bought by Wexner in 1989. By 2011 it was owned by Epstein’s Virgin Islands company Maple Inc. (transferred for $0). Sold in 2021 for ~$51M. Proceeds to victim’s fund.

Little St. James

70-acre island (USVI) Epstein purchased for ~$8M in 1998. Served as his main residence and alleged crime scene (nicknamed “Pedophile Island”). Complex of villas, helipad, etc. Now owned by Stephen Deckoff’s SD Investments

Great St. James

Larger adjacent USVI island bought by Epstein (~$20M by 2016 ). He planned a sprawling estate (amphitheater, marine lab) before 2019 arrest. Was purchased with Little St. James by Stephen Deckoff’s SD Investments for ~60M.

Palm Beach Mansion

7-bed waterfront estate on Florida’s Billionaire Row. Epstein bought it in the early 1990s and later placed it under contract (post-arrest) for ~$25.8M. Site of 2005 Palm Beach abuse case. Currently earmarked for demolition by new owner.

Zorro Ranch

(NM) 7,500-acre ranch near Stanley, New Mexico (dubbed “largest private home in NM” ). Purchased in 1990s, used as a rural retreat. Listed for sale in 2022 (asking ~$85M), sold mid-2023 to San Rafael Ranch LLC.

Avenue Foch Apt.

(Paris) Luxury apartment in Paris. Owned by Epstein, seized by French authorities after 2019. Sold late 2022 for €10.4M. Privately held.

JPMorgan Chase

Epstein’s bank (1998–2013). Allowed huge cash transactions, despite compliance red flags. Settled a 2023 lawsuit for $290M over enabling Epstein’s crimes.

Deutsche Bank

Epstein’s bank (2013–2018). Paid out ~$75M in 2023 to settle claims of aiding Epstein. Handled Epstein’s trusts in USVI and Europe.

Liquid Funding Ltd.

Offshore Bermudian shell company chaired by Epstein (2000–2007) to package mortgage-backed securities. Partly owned by Bear Stearns. Used to move large investment positions abroad.

Plan D LLC

(USVI) Epstein-owned Virgin Islands corporation. Registered his private planes (Gulfstream, 727) and possibly helicopters. Played role in manoeuvring funds (see SEC filings).

Jeffrey Epstein VI Foundation

Epstein’s private charity (founded 2000). Funded academic research (e.g. Martin Nowak). Criticised for lack of transparency and may have been used to channel donations for influence.

These entities and assets illustrate how Epstein’s wealth was both amassed and hidden.

Conclusion

Jeffrey Epstein’s financial empire remains a jigsaw puzzle pieced together by journalists, prosecutors, and whistleblowers. What is clear is that many pieces are missing or mysteriously aligned: a mega-rich “money manager” with virtually no disclosed clients, a web of shell companies spreading across continents, and a small circle of ultra-wealthy enablers (Wexner, Leon Black, and perhaps others still unknown). Through painstaking reporting and legal discovery, much of this complex trail has come to light: we know the routes of certain large funds, the names of key companies and accounts, and the transactions that underpin Epstein’s exotic lifestyle.

Yet Epstein’s true fortune-secrets may never be fully unveiled. Court records and Senate investigations hint at sums “well into the hundreds of millions” paid by deep-pocketed associates, but both privacy laws and friendly cooperation from previous governments have obstructed full disclosure. Likewise, the sensational theories of spycraft and blackmail have so far outpaced the evidence. Investigators focus instead on concrete trails – bank statements, property deeds, corporate filings – even as these occasionally vanish behind redactions.

Through 2025, each new revelation has confirmed one thing: Epstein’s wealth was not self-generated. Even now, executors must explain why a dismissed math teacher was living better than most billionaires. The victims’ compensation fund and the US Virgin Islands lawsuit are demanding answers. As journalist Julie Brown noted, Epstein’s case shows what happens when “money talks” in an unaccountable way. The hope is that ongoing civil actions and new subpoenas (like those sought by Sen. Wyden ) will uncover the last hidden pieces: who funded Epstein, who laundered funds for him, and thus how he really got all that money.

The Man from O.R.G.Y.

If Jeffrey Epstein’s death on 10 August 2019 reads like the opening of a spy thriller – a lone prisoner found hanging in a high-security lockup – that’s no coincidence. But unlike a neat ending, his demise only uncovers a new labyrinth of questions.

Sources

Public filings and reporting (bank suits, court exhibits, Senate letters) provide the backbone of this account. Key references include investigative articles by Vanity Fair, Miami Herald, ABC News, Bloomberg/Time, Reuters, and others, as well as documents from the U.S. Senate Finance Committee and Panama/Paradise Papers leaks. These cover developments up through mid-2025. They reveal an intricate financial portrait: high stakes offshore vehicles, corporate transfers for $0, real estate valued in the tens of millions, and suspicious payments that regulators now describe as “indicative of money laundering”. All major revelations and figures cited have been confirmed by court or official records to date.

Goldstein, M. (2025, June 6). Jeffrey Epstein Invested With Peter Thiel, and His Estate Is Reaping Millions. New York Times.

McEvoy, J. (2021, June 8). Billionaire Les Wexner reportedly ignored repeated warnings about longtime friend Jeffrey Epstein. Forbes.

Metcalf, T., Melby, C., & Alexander, S. (2019, July 8). Mystery around Jeffrey Epstein’s fortune and how he made it. Bloomberg.

Nally, L. (2020, October 9). I Called Everyone in Jeffrey Epstein’s Little Black Book. Mother Jones.

Petrarca, E. (2019, July 9). What is the link between Victoria’s Secret and Jeffrey Epstein? New York Magazine.

Sherman, G. (2021, July/August). The mogul and the monster: Inside Jeffrey Epstein’s decades‑long relationship with his biggest client. Vanity Fair.

Ward, V. (2003, March). The talented Mr. Epstein. Vanity Fair.

Offshore Alert (2024, July 24) Jeffrey Epstein: Liquid Funding Ltd. – Selected Filings.

Time Magazine. (2022, July 19). The troubling story behind Hulu’s new documentary Victoria’s Secret: Angels and Demons*. Time.

U.S. Senate Committee on Finance. (2025, April 30). Letter from Jonathan Blum to Senator Ron Wyden regarding investigation into Jeffrey Epstein’s sex trafficking network.

U.S. Senate Committee on Finance. (2025, June 17). Following new Epstein revelations, Wyden renews demand for Trump administration to produce Epstein files.

U.S. Senate Committee on Finance. (2025, March 12). Wyden letter to DOJ–Treasury–FBI on Epstein.

Wikipedia contributors. (2025, July). Jeffrey Epstein. Wikipedia.

Amazing how an ordinary person’s $200 transfer into a crypto account can be held up for 48 hours for “verification”, while millions transferred through shell companies “without clear purpose” are “waved through”.

Trump is melting down over Epstein. Share every story, meme, and cartoon and keep up the pressure! https://mdavis19881.substack.com/p/watch-video-testimony-from-woman